increase your chance of becoming public charge in the future! Today, we're going to dive into more on what kind of benefits are and aren't considered as Public Charge. Let's get to it:

What's I-944 Public Charge Ground of Inadmissibility?

Public charge ground of inadmissibility is part of the US immigration law. You need to be able to pass public charge rules in order to be qualified for a green card. Applicants who is likely to become a public charge in the future (who has used one or more public benefits for more than 12 months within any 36 months period) is generally inadmissible to the US and ineligible to be granted US permanent residency. Learn more here: Form I-944 In the Know.What benefits are and are not considered by I-944 Public Charge Ground?

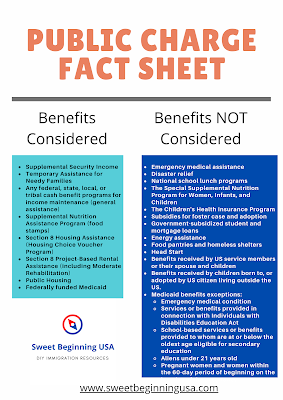

Generally, there are 3 most common exceptions: Children, Pregnancy, and Emergency. USCIS released a public charge rule fact sheet with more details, and I put together a chart based of the sheet:Benefits Considered in the Public Charge Rule Including:

- Supplemental Security Income

- Temporary Assistance for Needy Families

- Any federal, state, local, or tribal cash benefit programs for income maintenance (general assistance)

- Supplemental Nutrition Assistance Program (food stamps)

- Section 8 Housing Assistance (Housing Choice Voucher Program)

- Section 8 Project-Based Rental Assistance (including Moderate Rehabilitation)

- Public Housing

- Federally funded Medicaid (with exclusions! See below.)

Benefits NOT Considered in the Public Charge Rule Including:

- Emergency medical assistance

- Disaster relief

- National school lunch programs

- The Special Supplemental Nutrition Program for Women, Infants, and Children

- The Children's Health Insurance Program

- Subsidies for foster case and adoption

- Government-subsidized student and mortgage loans

- Energy assistance

- Food pantries and homeless shelters

- Head Start

- Benefits received by US service members (US armed forces, or active duty or any of the Ready Reserve components of the US armed forces)

- Benefits received by the spouse and children of US service members

- Benefits received by children born to, or adopted by US citizen living outside the US.

- Medicaid benefits exceptions:

- Emergency medical condition

- Services or benefits provided in connection with Individuals with Disabilities Education Act

- School-based services or benefits provided to whom are at or below the oldest age eligible for secondary education

- Aliens under 21 years old

- Pregnant women and women within the 60-day period of beginning on the last day of the pregnancy

- Find out more here on USCIS's public charge page.

Have you gotten any of the benefits above? It's good to know that there are always exceptions for women, children, and emergency! The rules are the rules, but there's always some flexibility and wriggle room.

Keep Reading.......

No comments:

Post a Comment

Thank you for leaving me a comment! I will review it shortly:) You can also contact me at chenevy99@gmail.com